Expert: Reduced VAT rate on fruit and vegetables to have economic effectThe Latvian government has decided to lower VAT rate on fresh vegetables, fruit and berries to 5%, triggering an active discussion on possible effects of the decision among professionals and consumers. Commercial director of retailer Elvi Latvija has voiced her opinion. Laila Vārtukapteine evaluated that applying a reduced rate of the value added tax on food products is a common practice in various European countries and Latvia has been one of the rare member states of the European Union, where a reduced VAT was only used on some baby food products. «Currently, the VAT on food products in Latvia is 21%. This means that more than a fifth of the price of any article at a shop goes into state coffers,» Vārtukapteine said. The commercial director of Elvi retail chain added that the overall effect would be that prices on fresh vegetables, fruit and berries would go down, but consumers have to remember that prices of these products will still fluctuate considerably depending on seasons. Reportedly, the new rate is planned to be applied to washed, peeled, shelled, cut and packaged fresh fruit, berries, vegetables and potatoes, but not products that have been thermally or otherwise processed. Ringolds Arnītis, the Parliamentary Secretary of the Latvian Ministry of Agriculture, commented: «To us, it is important to look for options and find solutions that help preserve entrepreneurship in the country and especially in rural territories.» The proposed amendments are still to be reviewed by the Saeima and if backed, the reduced tax rate would be introduced for the period from January 1 2018 to December 31 2020.

09-10-2017

Comments

|

Entertaiment & Arts

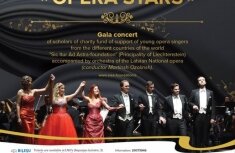

The Gala concert of young opera singers will be held in the Latvian National operaWithin the cultural mission for advance of Latvia as a cultural center of Northern Europe which is carried out by Fund “Baltic Musical Seasons”, on August 29 in the Latvian National opera will be held the Gala concert of young opera singers from the different countries of the world accompanied by symphonic orchestra of the Latvian National opera (conductor Martinsh Ozolinsh). |

Daily magazine about Latvia latviannews.lv

Arthur Schopenhauer

pribaltika.com

pribaltika.com

Russian version