Ruling coalition in Latvia may decide to put off PIT reductionThe coalition also intends to reach an agreement next week about matters associated with tax reform and healthcare funding. Politicians have been offered multiple variants for changes. No agreement has been reached over them so far, however. If additional compensating mechanisms are needed, the decision may be made to postpone the reduction of PIT to 20% for six months – 1 July instead of 1 January. Politicians may also discuss a more progressive PIT rate than initially planned. The current tax reform provides for two PIT rates – 20% for income under EUR 45,000 a year (EUR 3,750 a month) and income above EUR 45,000 a year. The World Bank believes PIT progressiveness along with social support for people with low income could help reduce inequality in Latvia. According to the bank’s estimates, this three-level PIT rate – 19%, 23% and 33% – along with non-taxable minimum will help reduce inequality and increase budget revenue. The proposal extended to the coalition provides for setting PIT at 20% for gross income under EUR 900 a month, 23% for income from EUR 900 to EUR 3,300 a month, 26% for income under EUR 8,000 or EUR 9,000 a month and 31% for the highest income, according to information from LETA. Another proposal to be considered by politicians will be regarding the introduction of a shorter period for payment of undivided profits from previous years. The proposal to change excise tax rates would have an insignificant financial effect. BNN/LETA

08-06-2017

Comments

|

Entertaiment & Arts

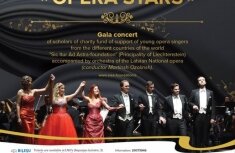

The Gala concert of young opera singers will be held in the Latvian National operaWithin the cultural mission for advance of Latvia as a cultural center of Northern Europe which is carried out by Fund “Baltic Musical Seasons”, on August 29 in the Latvian National opera will be held the Gala concert of young opera singers from the different countries of the world accompanied by symphonic orchestra of the Latvian National opera (conductor Martinsh Ozolinsh). |

Daily magazine about Latvia latviannews.lv

Michel de Montaigne

pribaltika.com

pribaltika.com

Russian version